Knowledge and Insights: Newsletters

Self-Employed Retirement Plans: What Plan Is Right For You?

Self-employed (SE) individuals have the opportunity to create a nest egg while potentially reducing their current tax liabilities. An added challenge to being self-employed is understanding the best way to…

How To Use & Optimize the Benefits from a Health Savings Account (HSA)

What is a health savings account (HSA)? A health savings account (HSA) is a savings vehicle established to set aside funds tax free to pay for health care expenses. HSAs,…

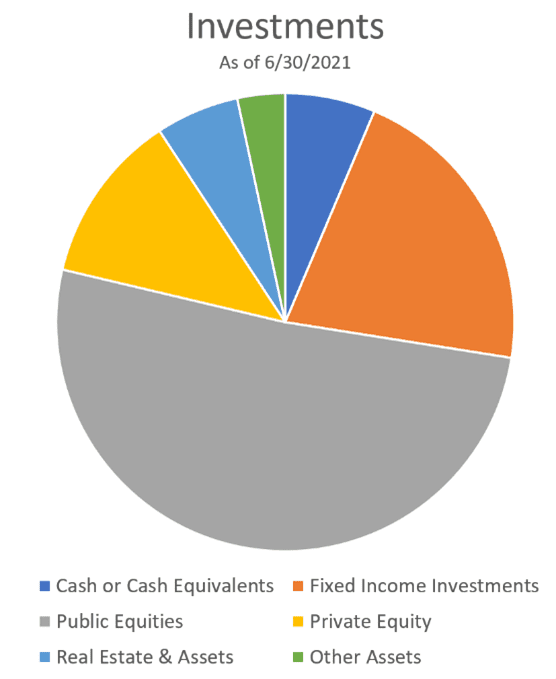

Understanding Your Retirement & Benefits in a Government Plan

With another fiscal year-end (June 30th) in the rearview for the State of New Jersey’s Division of Pensions and Benefits (the Division), it is as good a time as any…

What Do You Need to Know About the Accelerating Charitable Efforts (ACE) Act?

The Accelerating Charitable Efforts (ACE) Act is proposed legislation aimed at reforming the tax laws that cover charitable donations made by Private Foundations (PFs) and Donor Advised Funds (DAFs). The…

Why You Need a Forensic Accountant in Your White-Collar Crime & Corporate Fraud Cases

It’s easier and less expensive to prevent corporate fraud and white-collar crime than to recover from it, or defend against it, after the fact. According to the Association of Certified…

Benefits of an Outsourced CFO

Many emerging growth and middle-market companies stand to benefit from the expertise of an experienced financial and accounting professional but are hesitant to carry the cost of a full-time chief…

Economic Update: What Could Go Right?

The first quarter of 2022 was a reminder that there are times, though rare, when both the bond market (the “safe stuff”) and stock market can go down at the…

In Search of a Board Member? Where to Look to Find that Elusive Candidate

Did you know that there are over 2,500 nonprofits in Mercer County, New Jersey alone? Given how many nonprofits are in our region, and that good nonprofit governance practices recommend…

The Challenges and Opportunities HR is Facing in a Digital-First World

The world has changed for all of us, but for inherently culture-oriented organizations, such as nonprofits, the change has been substantial. Nonprofits rely on human connection to build interest in…

Love Them or Leave Them? Financial Considerations When Contemplating a Divorce

Unfortunately, only you can answer that question. According to WorldPopulationReview.com, in the United States 50% of you are choosing to leave him or her and for second or third marriages…