Knowledge and Insights: Newsletters

Safeguarding Sensitive Data: Cybersecurity, Compliance & Privacy for Non-Profit Organizations

In an increasingly digital world, nonprofit organizations are handling vast amounts of sensitive data, from donor information to beneficiary records. Protecting this data is not only a legal obligation but…

Is CECL Applicable to my Nonprofit Organization?

WHAT IS CECL? Current Expected Credit Loss (CECL) is an accounting standard introduced in 2016 by the Financial Accounting Standards Board (FASB) with the objective of improving the accuracy and…

The Benefits of BSA Staff Augmentation for Banks

Financial Institutions face a unique set of challenges and responsibilities, especially within their Bank Secrecy Act (BSA) departments. An institution’s BSA/AML staff is the first line of compliance for AML…

Banking on Fintech: Key Considerations for Banking as a Service (BaaS)

Over the last several years, technological advancements have transformed our lives, revolutionizing the way we connect, work and live. We leverage many applications on our phones and other devices to…

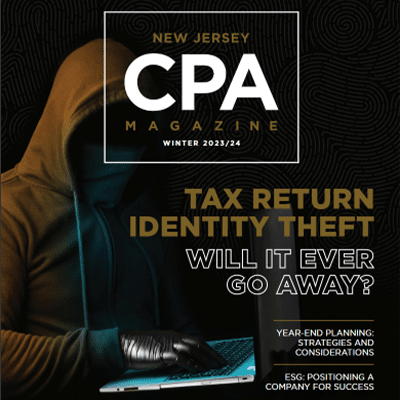

Jeffrey Baresciano Featured in NJ CPA Magazine – Considerations When Providing Valuation Services in Litigation & Investigations

Jeffrey Baresciano, CPA, CFF, ABV, CVA, Director with Mercadien, was featured in the Winter 2023/24 New Jersey CPA Magazine. Check out the full article below. Litigation and investigative engagements often…

The Importance of Royalty & Contract Compliance

In the intricate world of business, royalty and contract compliance is not just a legal requirement; it’s fundamental to long-term success. As a critical aspect of your operations, contract compliance…

Benefits of Performance Auditing

Recipients of federal and/or state aid funding are accountable for carrying out the programmatic objectives and outcomes as reflected in in applicable laws, regulations, policies, grant agreements, and contracts. Audits…

Nonprofit Succession Planning: Secure Continuity & Drive Growth

Succession planning is a critical component of organizational management and sustainability, especially for nonprofits. It involves identifying and developing individuals within an organization to take on key leadership roles when…

Lessons Learned for Nonprofits: Reflecting on the Lease Accounting Standard

ASC Topic 842, the accounting standard for leases, has brought significant changes for nonprofit organizations in their financial reporting. Over the past several years, these organizations have reassessed and reevaluated…

Model Governance: How to Formalize the Program

As a small financial institution, you may not have formalized a comprehensive model risk governance program. Model governance refers to the framework and structure an institution establishes to oversee and…