Salvatore Zerilli

Banking on Fintech: Key Considerations for Banking as a Service (BaaS)

Over the last several years, technological advancements have transformed our lives, revolutionizing the way we connect, work and live. We leverage many applications on our phones and other devices to…

Model Governance: How to Formalize the Program

As a small financial institution, you may not have formalized a comprehensive model risk governance program. Model governance refers to the framework and structure an institution establishes to oversee and…

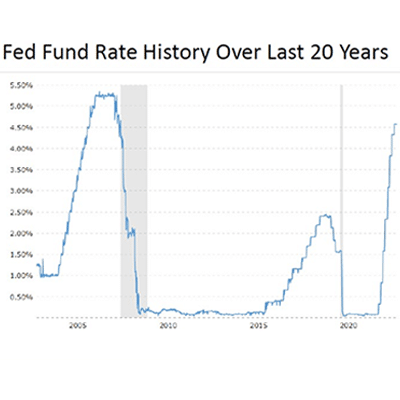

10 Ways to Protect Your Institution During Uncertain Times

We’ve all read the shocking news of recent financial institution failures. We’re also well aware of quickly rising interest rates and volatility in the market. Regulatory scrutiny is coming, and…

Mercadien Serving as Subcontractor on U.S. SBA Awards $13 Million Contract, for Supervised Lenders 7(a) Guaranteed Loan Program

Princeton, NJ and Philadelphia, PA – The Mercadien Group is pleased to announce that it has been awarded through its partner company, Kingstonville, LLC, a $13 Million one-year contract, with…

Contact Us for PPP Loan Forgiveness Processing Assistance

Mercadien is ready to assist you in facilitating the CARES Act Paycheck Protection Program (PPP) loan forgiveness processing. The SBA stated that Lenders are expected to perform a good-faith review,…

SBA Awards $20 Million Contract to Mercadien JV for Risk Mgmt. of 504 Loans

The Mercadien Group is pleased to announce that its affiliate company, Kingstonville-Mercadien JV, LLC, has been awarded a five-year contract with the U.S. Small Business Administration (SBA) to provide risk-based…

A World of Innovation

This article is featured in the Spring 2018 issue of NJ Banker Magazine. Stop and think about this: We keep hearing about innovation in just about every facet of our…

Assessing Your Cyber Security Risks and Preparedness

Technological security is not only increasingly important today, but also undergoing a directional shift due to the prevalence and ingenuity of cyber-hackings. The true statistics about these are more alarming…

NJ Banker Magazine Features Article on Internal Audit by Salvatore Zerilli

Internal audit, when properly implemented, is an essential element to assist your financial institution in discovering control weaknesses, regulatory and policy violations, and operational inefficiencies. Such self-scrutiny provides an institution…

Achieve Growth Through Compliance Leadership

The banking industry has seen noted changes in income margins for institutions of all sizes over the last five to ten years. Growth strategies focused solely on revenue channels are…